Is the Dutch tax credit for innovation (the WBSO) complex? Not with a solid WBSO administration!

A recent official report on approaches to tax schemes has shown that the WBSO, a tax scheme to promote R&D work within the Netherlands, is rated positively in terms of effectiveness and efficiency. However, the same report also acknowledges that the WBSO is considered complex in execution. In this article, we take a deeper look at three crucial aspects of the WBSO execution: the hour administration, project administration and WBSO audits by the RVO (the Netherlands Enterprise Agency). Do you have these aspects well managed? Then the WBSO, despite its complexity, is an exceptionally good tool for more affordable innovation in the Netherlands.

The importance of an accurate hour administration

An accurate hour administration is essential when applying for and using the WBSO scheme. Hezelburcht understands the complexity of the WBSO. We have therefore developed a structured approach to support clients in setting up effective timesheet systems. Using automated tools and years of experience, we can help organisations make the actual hours spent on innovative projects transparent and verifiable to RVO.

The importance of a thorough project administration

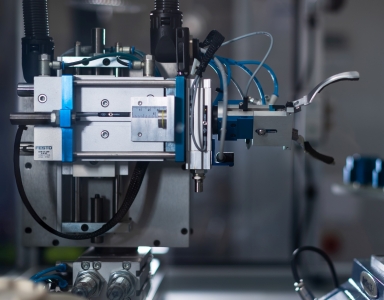

Time records alone are not enough. As an applicant, you must also prove that the projects were actually carried out. Reports, meeting documents, correspondence, calculations, photos of prototypes. This is all important information that can be requested by RVO. This is why we recommend keeping a well-structured project administration. This allows you to make the link between the registered hours and the projects that have been showcased in the WBSO application. A well-organised project administration not only facilitates the application procedure, but also provides valuable input for preparing an effective WBSO evaluation report.

The importance of RVO audits (and a good preparation)

RVO audits are a very important part of the WBSO process. The goal of these audits are to check if the granted WBSO is legit. Random audits are carried out by RVO on hour and project administration to check whether the intended R&D work has actually been carried out. RVO can impose fines and take other measures if the scheme has not been applied legitimately. And that is something you want to avoid!

Final conclusion: ensure you have a good WBSO administration

Because of the complexity of the WBSO, it is crucial to have a decent WBSO administration. This will give you control on your R&D-projects, and RVO will confirm during an audit that you have correctly executed the WBSO grant.

Prevent problems, Hezelburcht helps with the WBSO administrations and RVO audits

Our in-depth knowledge of the WBSO enables us to prepare clients for these audits and ensure that they meet the requirements. For example, we can check your hour and project administration for completeness and accuracy, provide additional documentation, and act as a point of contact during an audit. Do you want to make sure you are well prepared? Our WBSO specialists can carry out an internal audit at your company.

Contact us. We will be happy to explain how we can help you set up your WBSO administration or guide you through an RVO audit.

Plan a meeting with a WBSO specialist

Or call directly to: 088 495 20 00